As the company repositions its aftermarket division as a lifecycle solutions provider, it is betting big on its Vitesco acquisition to strengthen its electrification offering and is expanding its subsidiary Koovers to take advantage of India’s growing digital penetration and car parc.

With rapid changes in the mobility ecosystem, German automotive supplier Schaeffler is transitioning itself from a spare parts supplier to a solutions provider. The company’s aftermarket division was reorganized as Vehicle Lifetime Solutions (VLS) in mid-2024 in a shift from a product-led approach to an ecosystem-led approach. The division aims to provide vehicle repair and service solutions at every stage of a vehicle's lifecycle.

The increasing performance levels in vehicles and the shift to electrification means workshops need to have the ability to repair more complex vehicles than before. This lifecycle-oriented approach is also becoming more popular among other aftermarket suppliers. German supplier Mahle announced in late 2024 that its aftermarket business unit has been rebranded as Lifecycle and Mobility with additional competencies in electrification and digitalization.

“Conventional drives with combustion engines are and will remain important, but a fundamental change of direction toward electric vehicles, customized solutions and a complex mobility concept is required,” Micah Shepard, President, VLS, Asia-Pacific, Schaeffler tells S&P Global Mobility in an interview. At the recently held Bharat Mobility Global Expo in New Delhi, India, Schaeffler showcased several automotive aftermarket solutions, including the 3-in-1 Electric Axle, which integrates the motor, transmission and power electronics for enhanced EV performance, high-voltage axle drive (EMR4), sensors, controls and actuator solutions from its combined portfolio with Vitesco Technologies, which it acquired in 2024.

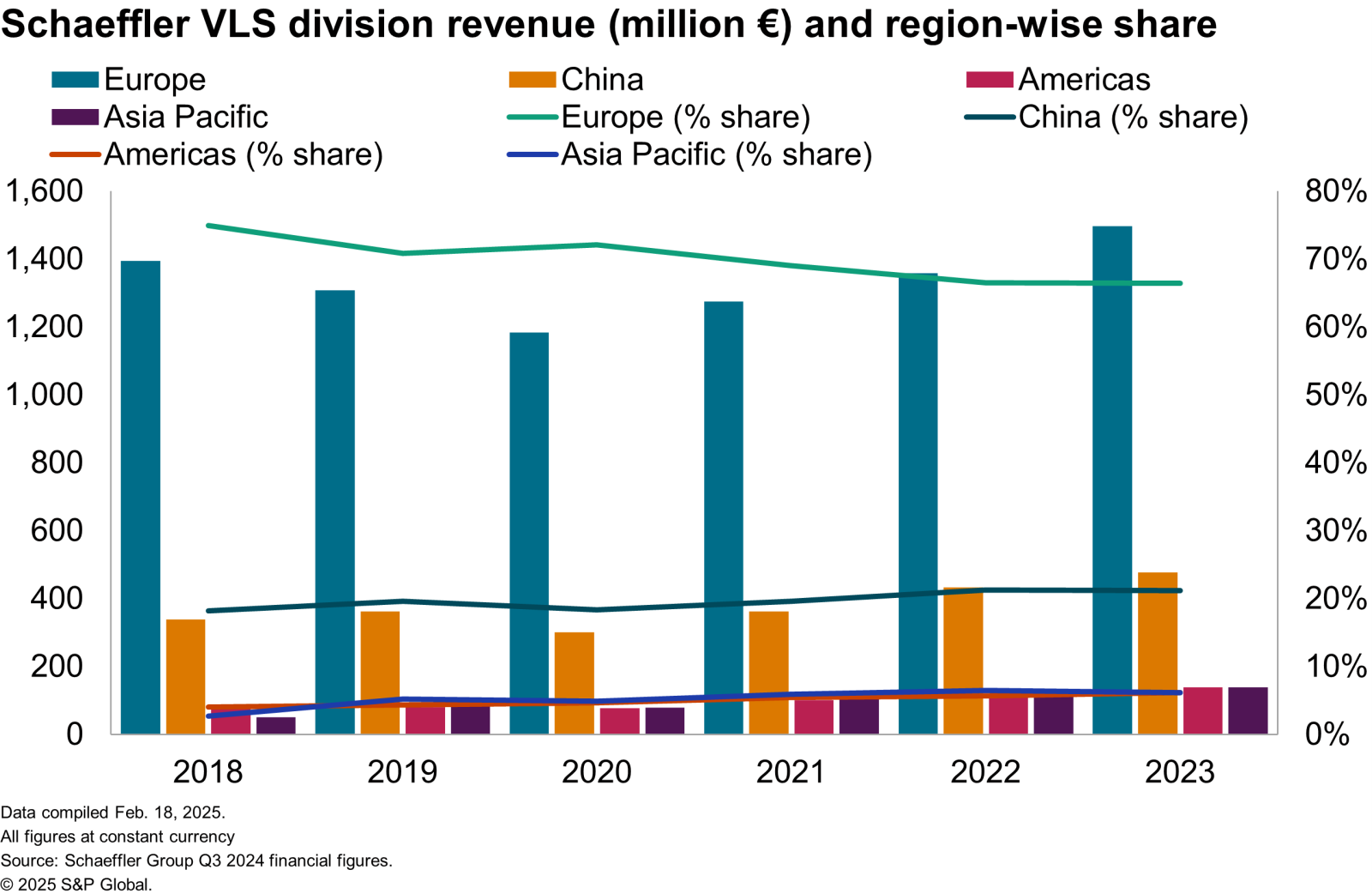

The aftermarket business (now VLS division) accounted for nearly 14.0% of Schaeffler Group revenue in 2023, up from 13.0% in 2018. The company anticipates the largest increase in both vehicle population and demand for repairs up to 2028 to occur outside of Europe, with a significant part of it coming from the Greater China region. The Asia-Pacific division’s revenue share among the company’s total aftermarket revenue has more than doubled from 2.7%, or €51 million, in 2018 to 6.2%, or €139 million, in 2023, according to the company’s third quarter 2024 financial figures. Shepard says the division has achieved double-digit growth across the Asia-Pacific region and continues to expand its reach and innovation footprint.

In the interview with S&P Global, Shepard talks about the synergies with Vitesco, balancing costs versus innovation in the shift to electrification, the company’s localization strategy within Asia-Pacific and growth plans for its e-commerce platform acquisition Koovers.

The following is an edited excerpt of the conversation.

S&P Global Mobility: Could you provide an overview of Schaeffler’s Vehicle Lifetime Solutions (VLS) business for Asia-Pacific and some key demand drivers for the division?

Micah Shepard: With Vehicle Lifetime Solutions, we are driving the shift from a product-oriented to an ecosystem-oriented approach to remain a leading provider of vehicle repair and service solutions at every stage of a vehicle's lifecycle.

Whether our customers need profitable, market- and garage-orientated solutions for combustion engines, hybrids or electric cars: We will support them across the entire vehicle lifecycle, delivering spare parts and repair kits in OE [Original Equipment] quality under our brands LuK, INA, FAG and Schaeffler TruPower, and with a service approach that is unbeatable in customer proximity.

Additionally, REPXPERT, our service brand, offers comprehensive online and offline training programs via REPXPERT training van designed to upskill technicians, garages and industry professionals. It provides access to technical resources, product installation videos, live training sessions and diagnostic tools, helping industry stakeholders enhance their expertise in maintaining and repairing vehicles. Through REPXPERT, Schaeffler is bridging the skill gap and ensuring the effective application of its products across the APAC markets.

How is the VLS division performing and how do you plan to position it amid the shifts in the automotive industry?

VLS division of Schaeffler has achieved double-digit growth across Asia Pacific region and continues to expand its reach and innovation footprint. With changes in the automotive industry, VLS plays a crucial role in ensuring future readiness and driving innovation. By building a solid aftermarket core with global sales presence in IAM and OES, Schaeffler is expanding its range of products, services and capabilities in the VLS division to drive innovation in new business. Our vision is to be the leading player in the vehicle repair and service eco-system for all upcoming new technologies and requirements.

As someone who manages the VLS division for different countries, what are some regional differences that you are seeing from an aftermarket point of view?

The aftermarket industry is influenced by a mix of cultural preferences, regulatory environments, economic conditions and vehicle ownership trends. For instance, in the Asia Pacific region, certain countries show a stronger preference for local brands and manufacturers, while some countries prefer original spare parts and independent aftermarket products. By considering these factors, VLS Asia Pacific customizes its approaches to address these specific differences effectively.

Can you elaborate on the synergies with Vitesco and how you see that shaping out over the next few years?

The integration of Vitesco Technologies into the overall company is a logical and central step to further Schaeffler’s expansion. We aim to develop a globally integrated platform provider addressing customer needs along the entire vehicle lifecycle. We will continue to offer Vitesco range of products for internal combustion engines to the independent aftermarket and bring products relevant for Electric Powertrain into our portfolio to make them available for our customers. Our respective skills and technologies complement each other.

What is the company’s localization strategy for India but also your other Asia-Pacific markets?

In the Asia-Pacific region, we have expanded our operations with the launch of the new VLS Central Logistics Center in Thailand. This expansion enhances our market responsiveness and competitive edge. With a strong market presence and growing demand for high-quality aftermarket solutions, Schaeffler VLS division aims to increase its market share in India and plans to further expand its manufacturing capabilities and partnerships.

Could you shed some light on the VLS business in India? Any unique country specific innovations from the R&D team you could tell us about?

India plays a pivotal role in this strategy due to its rapid economic growth, evolving automotive sector and government push for cleaner mobility solutions. Investments in digitalization, electrification and a robust aftermarket presence are key pillars of our growth in India. Collaboration with OEMs and alignment with local market needs ensures that India remains a focal point in the APAC strategy. Schaeffler has made strides in EV technologies, including efficient electric drive systems, thermal management modules, innovative bearings and sensors for EV applications. These technologies have been deployed globally and are now being localized for the Indian market.

With electrification solutions, both from parts and service aspects, how important is it to balance costs with the need for innovation and how are you achieving that?

While innovation drives advancements in efficiency, safety and sustainability, cost considerations ensure accessibility and adoption at scale. In addition, local production in India is key to achieve the cost target but also speed to market and understanding the local requirements.

What is your strategy for growth with Koovers? E-commerce is set to assume more importance as digitalization grows but does the fact that a large part of India’s aftermarket sector remains unorganized pose a challenge?

In India, overall economic growth is supported by high ecommerce penetration linked with strong indicators for the automotive aftermarket. Digital penetration in this market is expected to increase from 1% in 2022 to between 7% and 10% in 2030. The total increase in the number of cars, as well as average car age, will lead to a 75% increase in the automotive aftermarket in India by 2030. Our acquisition of the Indian company KRSV and its fast growing automotive aftermarket B2B ecommerce platform Koovers enables user to expand into the digital business in India. Koovers is an ideal addition to Schaeffler’s aftersales activities in India to service the workshops. It is on expansion mode that increase the geographical presence and aims to service a wider market. Our approach is having the right parts, right price at the right time in the fast-evolving aftermarket digital landscape.

Author: Nishant Parekh, Senior Research Analyst, Automotive Supply Chain, Technology and Aftermarket (nishant.parekh@spglobal.com)