A slight modification or accident to a vehicle could make its driver-assist and crash-avoidance technology not work properly — or at all. As more ADAS vehicles enter the fleet, the service and repair industry is struggling to keep pace.

With the average age of vehicles on US roads at 12.5 years, new-car shoppers returning to the market may be unfamiliar with some of the advanced driver assistance systems (ADAS) applications now available. And even though many owners of newer cars have driven ADAS-equipped vehicles for several years, they may not have needed a repair or performed a modification that impacted those features or sensors.

ADAS are an important development in vehicle safety — especially as consumer demand and implementation by automakers move from premium vehicles and into the mainstream market.

Although consumers — and even some dealer service technicians — may not know that even minor adjustments to vehicles can throw those sensitive driver-assist and crash-avoidance systems out of calibration so they no longer work as designed. Installing larger wheels, replacing a radiator or even repairing a cracked windshield disrupt these systems and defeat their purpose.

The repair industry faces a challenge in dealing with ADAS technology. In a survey from February 2023 by the US non-profit group Insurance Institute for Highway Safety (IIHS), about half of the vehicle owners who had a repair that involved at least one of their ADAS applications said they had issues with the system after the job was complete.

More than 3,000 owners of vehicles equipped with front crash prevention, blind spot detection, rear-view warnings or other visibility-enhancing cameras were surveyed. The higher incidence of post-repair issues suggested that auto repair workers are struggling with the calibration process.

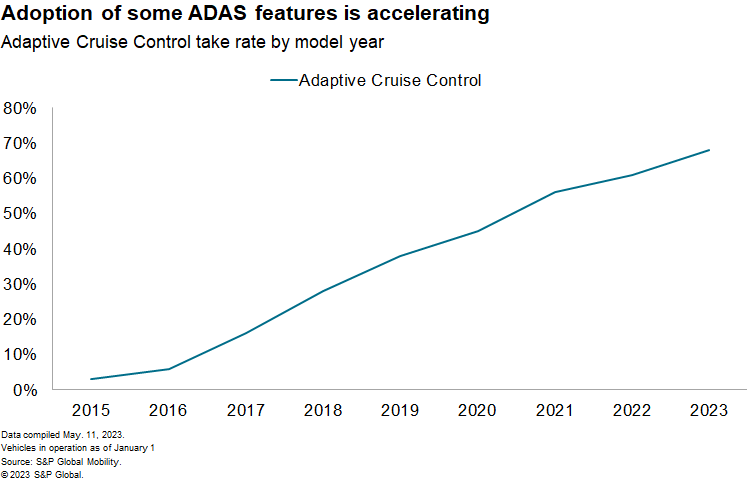

The adoption of ADAS technology among new vehicles began transitioning from luxury into the mainstream space in 2015, when Toyota made Toyota Safety Sense standard across its vehicle line, with other brands following suit. Today, the take rate of adaptive cruise control has increased significantly over the past seven years, going past 60% with 2022 model year vehicles in the US — and it will continue to grow rapidly, according to S&P Global Mobility analysis.

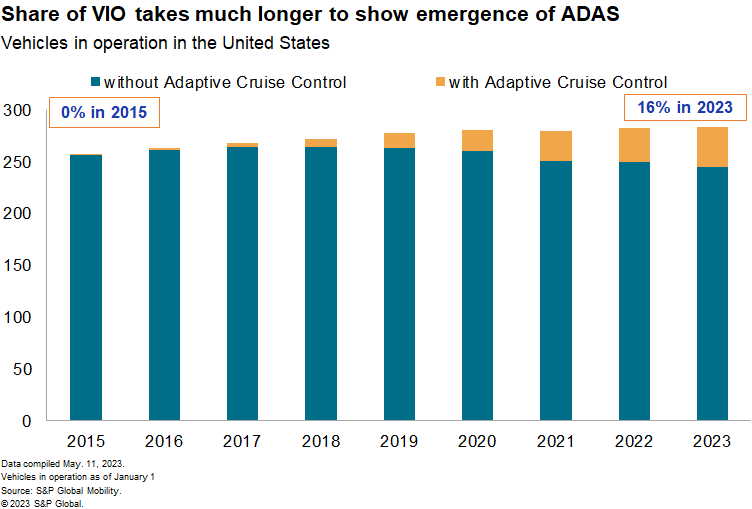

However, despite that rapid growth curve of installations in new vehicles, the impact on the overall vehicle fleet is taking much longer to manifest. That said, more than 15% of the US vehicle fleet today has adaptive cruise control. Combined with the accelerated pace of new vehicle adoption, that percentage will continue to grow. This increase will present several opportunities and challenges for repair, maintenance and calibration of these systems.

All these systems must be calibrated after a repair — even when it does not involve unplugging, replacing or remounting a sensor. Something as innocuous as a change in tire or wheel size could impact the ability of a vehicle's crash avoidance features to work properly.

Types of driver-assist systems

ADAS come in two types: passive, where the driver is alerted to situations such as the vehicle veering away from the lane; and active, where the systems automatically take some action, such as braking in an emergency. Some popular ADAS applications, such as adaptive cruise control and lane departure warning systems, which were introduced in flagship luxury vehicles two decades ago, are becoming more prevalent in less-expensive vehicles. Other applications finding their way into the mainstream include forward collision warning, lane-keeping assist, automatic emergency braking and blind spot warning systems.

If a passive application such as blind spot warning develops an issue, drivers could still physically check their blind spots. However, when active functions such as adaptive cruise control do not function as expected, it could cause a collision if a driver becomes overreliant on the application. Therefore, it is especially critical to ensure ADAS applications are properly recalibrated after common repair procedures so these features, which often are designed to act without driver input, produce the expected result.

As technology systems age, they also require maintenance to continue working properly. These processes are complicated and require specialized training and equipment. However, the attention paid to "old" ADAS technology may wane as newer, more-advanced features get installed in the latest vehicles. Parts supplies for the old tech may dwindle, and finding service techs able to work on a 10-year-old (or older) ADAS application may become a challenge without continuing education.

Role of calibration

Calibrations can range from being fairly simple — involving brake pedal position, steering angle sensors, liftgate, window positions or tire pressure monitoring — to more complex, involving radar systems, vehicle cameras or the nascent segment of lidar sensors.

Broadly, there are two types of calibration procedures:

Static calibration, which is done using precision aiming equipment along with a diagnostic scan tool with the vehicle in a stationary position; and

Dynamic calibration, requiring the technician to drive the vehicle at a manufacturer-specified speed over a certain distance, and which allows the onboard radar and camera systems to collect sufficient data and perform self-calibration. In some cases, this calibration can also be done by a consumer without any special equipment. This process can be referred to as "consumer dynamic calibration." In this sense, camera and radar systems can self-calibrate to a significant extent — which is the goal for OEMs and suppliers.

When a car is involved in a collision, it is normal for calibration to be performed, often as part of a workshop's standard procedure. But did you know, seemingly straightforward repair jobs also require ADAS application calibration? For instance, cracked-windshield repairs necessitate calibration of crash avoidance sensors like the windshield-mounted camera that frequently supports multiple features. Even a 1-degree change in the camera position at the windshield could mean a 1.7-meter deviation 100 meters down the road, resulting in the target area being significantly off trajectory. This could lead to the vehicle failing to detect and alert the driver to oncoming hazards.

Similarly, removing a front bumper to get to a radiator or an HVAC condenser would also require calibration of ADAS sensors — such as radar or lidar that are frequently installed behind the bumper or grille. Other instances requiring recalibration include suspension or steering repair, rear-view mirror replacement, wheel alignment, or changes in ride height or tire size.

Calibrating ADAS on modified vehicles

ADAS can sometimes conflict with the booming aftermarket parts sector and a customer base that expects vehicle modifications to integrate seamlessly with their vehicle. Therefore, it will be critical for customizers of newer-model vehicles to learn how to work with ADAS technologies to ensure their modified vehicles' onboard safety systems are still working within factory spec.

Suspension components, wheels and oversize tires for pickups and SUVs are among the most popular parts in the specialty-equipment aftermarket, and vehicles equipped with such components need recalibrating of original-equipment ADAS sensors, according to the Specialty Equipment Market Association (SEMA).

Installing a set of auxiliary lights, a winch bumper or other accessories could even require ADAS sensors to be relocated. Some OEMs or suppliers provide some measure of accommodation in their vehicle designs and consulting the OEM or supplier installation manuals may provide guidance, a SEMA report stated. As ADAS functionality evolves into more comprehensive automated driving, however, it is unclear whether or to what extent this accommodation may continue. This is especially true as automakers begin to assume legal liability for the safe operation of highly automated vehicles.

The association is researching on behalf of its members to create a series of best practices on the proper ways to address ADAS functionality on modified vehicles so that all the sensors work, Mike Muller, ADAS engineer for SEMA Garage Detroit, told S&P Global Mobility.

However, the rate of ADAS innovation has outpaced regulators' ability to update safety standards. The Federal Motor Vehicle Safety Standards have not yet mandated or regulated any specific ADAS technology — although 15 automakers have voluntarily pledged to make AEB standard equipment in new models by September 2022 (many OEMs have already complied).

"There are a lot of innovations in the implementation of cameras and radars, but there are no standards for them in North America," Muller said. "That's an important distinction, because once something becomes mandated, such as ABS or ESC, then there's a standard against which it can be tested."

Implications for consumers

For consumers, the increasing adoption of ADAS in vehicles and complicated procedures to maintain them could mean increased repair and insurance costs. For instance, in the US, while a simple windshield replacement can cost as little as US$250, vehicles equipped with front crash prevention technology were much more likely to cost US$1,000 or more — with much of the higher cost related to calibration, according to a Highway Loss Data Institute (HLDI) study.

Sensors and other components are often located on the vehicle's exterior, mostly on the leading edge of the vehicle — a common point of impact in collision claims. Fixing these systems in the event of a crash can result in higher repair costs, especially if it requires replacing a sensor. For example, an HLDI analysis indicates curve-adaptive headlights tend to be more expensive to replace and calibrate than conventional halogen headlights.

Locating forward-looking sensors that support forward collision warning and automatic emergency braking in the front bumper could make equipped vehicles more susceptible to increased repair costs, as well. A joint study by IIHS and HLDI in 2022 revealed that the average payment per claim for damage to the insured vehicle with auto-brake was US$117 higher than for vehicles not equipped with the feature.

However, lower crash rates overall are a clear benefit of these technologies. Reductions in the frequency of collision claims have the potential to offset some of the additional expense of radar or other forward-looking sensors. The 2022 HLDI study revealed that crash avoidance features such as AEB enabled a 50% decline in front-to-rear crashes, AEB with pedestrian detection enabled a 27% decline in pedestrian impacts and the rear automatic braking feature resulted in 78% less crashes while reversing.

That said, calculating money saved from crashes that do not happen versus the cost of the safety system that prevented the crash is a matter of driver safety and social cost, rather than an economic calculation between the cost of collision avoidance and maintenance.

What ADAS means for vehicle servicing

The growing penetration of ADAS tech means it is not something repair shops can ignore. Although this also presents an opportunity for garages to take advantage of the growing service business and become skilled at identifying, diagnosing and calibrating these systems. If not, workshops could risk ruling themselves out of business altogether in the long term.

In fact, the interdependence of routine car repair procedures with ADAS calibration should make service technicians and shop owners think about the opportunity. For example, wheel alignment shops could examine getting into ADAS inspection because an accurate wheel alignment on most vehicles will require an ADAS reset.

Before an independent shop gets involved with the technology, there are a few things to consider. When it comes to ADAS calibration tools and service information, there are several options to choose from — including an aftermarket scan tool as opposed to an OEM tool. The former is suitable for repairers who work on vehicles from diverse makes routinely, while the latter could be more suitable for shops specializing in vehicles from specific OEMs. With each OEM using specific sensors and suppliers to enable ADAS, and with these ADAS and automated driving systems becoming more complex in both design and operation, repair shops may find it easier to specialize in a particular brand for this type of work.

Additionally, performing ADAS static calibration accurately requires a large space, and this can sometimes be a hindrance for repairers that do not specialize in it. The amount of space depends on the type of equipment used, but ADAS calibration technology providers recommend a space of 45 feet by 30 feet to calibrate most vehicles, with more space needed if the shops work with large vehicles or trailers. Moreover, the space will require a flat floor, along with uniform and adjustable lighting with no outside light intrusion; poor lighting is said to lead to inaccurate recalibration of sensors.

For dynamic calibration, garage technicians will need a good test route on which speed markings, road markings and signs are visible. Performing all the calibration on the same route will result in consistency.

The growing implementation of ADAS is considered one of the most critical new technological advantages — but it comes with challenges. Understanding how to repair and recalibrate the crash avoidance tech — especially as it ages — is increasingly becoming a priority in the vehicle repair and service industry. For garages, following stated repair procedures in their exact order and ensuring calibration is done in a safe and effective environment will be key to ensuring that vehicles leave the workshop performing as per factory spec, so the driver and occupants remain safe.

We are entering a time of ADAS-native drivers who may take the features for granted. In such instances, drivers could be increasingly vulnerable to crash situations if the ADAS applications do not perform as they should. Properly maintained cars are safer, more capable and more attainable than ever. However, drivers, dealers and repair shops need to be aware of the maintenance and repair requirements to keep them that way.

Listen To A Podcast On This Topic With S&P Global Mobility Experts

Author: Nishant Parekh, Senior Research Analyst, Automotive Supply Chain, Technology and Aftermarket

nishant.parekh@ihsmarkit.com